Chipotle’s Business Model and Performance

Chipotle Mexican Grill is a popular fast-casual restaurant chain known for its focus on fresh, high-quality ingredients and customizable menu options. The company has experienced significant growth in recent years, becoming a major player in the fast-casual dining industry. This section will analyze Chipotle’s business model, examine its recent financial performance, and compare its performance to its competitors.

Chipotle’s Business Model

Chipotle’s business model centers around providing a simple, yet customizable, menu of burritos, bowls, tacos, and salads. The company focuses on using fresh, high-quality ingredients, including locally sourced produce whenever possible. Chipotle also emphasizes its commitment to sustainable and ethical sourcing practices, which resonates with environmentally conscious consumers.

- Strengths:

- Strong brand recognition: Chipotle has established a strong brand identity known for its fresh ingredients and customizable menu. This has contributed to high customer loyalty and repeat business.

- Limited menu: By focusing on a limited menu of core items, Chipotle can efficiently manage its supply chain and maintain consistent quality. This also simplifies the ordering process for customers.

- Focus on fresh ingredients: Chipotle’s emphasis on using fresh, high-quality ingredients, including locally sourced produce, appeals to health-conscious consumers and differentiates the company from traditional fast-food chains.

- Strong digital presence: Chipotle has invested heavily in its digital platform, offering online ordering, mobile payment, and a robust loyalty program. This enhances customer convenience and allows for targeted marketing efforts.

- Weaknesses:

- Higher prices: Compared to traditional fast-food chains, Chipotle’s menu items are priced higher. This could be a barrier for price-sensitive customers.

- Limited menu options: While a limited menu can be a strength, it can also limit customer choice. Some customers may prefer more variety or specialized options.

- Operational challenges: Chipotle has faced challenges in maintaining consistent food safety standards in the past, resulting in negative publicity and temporary closures. This highlights the importance of effective operational management.

Chipotle’s Recent Financial Performance

Chipotle has consistently demonstrated strong financial performance, with revenue and earnings growth exceeding industry averages.

- Revenue: Chipotle’s revenue has grown steadily in recent years, driven by increased customer traffic and higher average check sizes. In 2022, the company reported revenue of $8.5 billion, a significant increase from $6.9 billion in 2021.

- Profit margins: Chipotle has maintained healthy profit margins, indicating its ability to effectively manage costs and generate profits. In 2022, the company’s operating margin was 18.7%, a slight decrease from 20.5% in 2021. However, this remains a strong margin compared to its competitors.

- Growth trends: Chipotle’s growth trajectory remains positive, with plans for continued expansion of its restaurant network. The company is also investing in technology and innovation to enhance customer experience and drive future growth.

Comparison to Competitors

Chipotle competes with a variety of other fast-casual restaurant chains, including:

- Qdoba Mexican Eats: Qdoba offers a similar menu of customizable Mexican-inspired dishes, but with a slightly wider range of options. It also has a larger restaurant footprint than Chipotle.

- Moe’s Southwest Grill: Moe’s Southwest Grill provides a similar concept to Chipotle, but with a more casual and family-friendly atmosphere. Its menu features a wider variety of toppings and sauces.

- Panera Bread: While Panera Bread offers a broader menu of sandwiches, soups, and salads, it competes with Chipotle in the fast-casual space. Panera has a strong focus on quality ingredients and a loyal customer base.

Chipotle distinguishes itself from its competitors through its commitment to fresh ingredients, customizable menu, and strong brand identity. However, it faces competition from established players in the fast-casual market, and its success will depend on its ability to continue innovating and adapting to evolving consumer preferences.

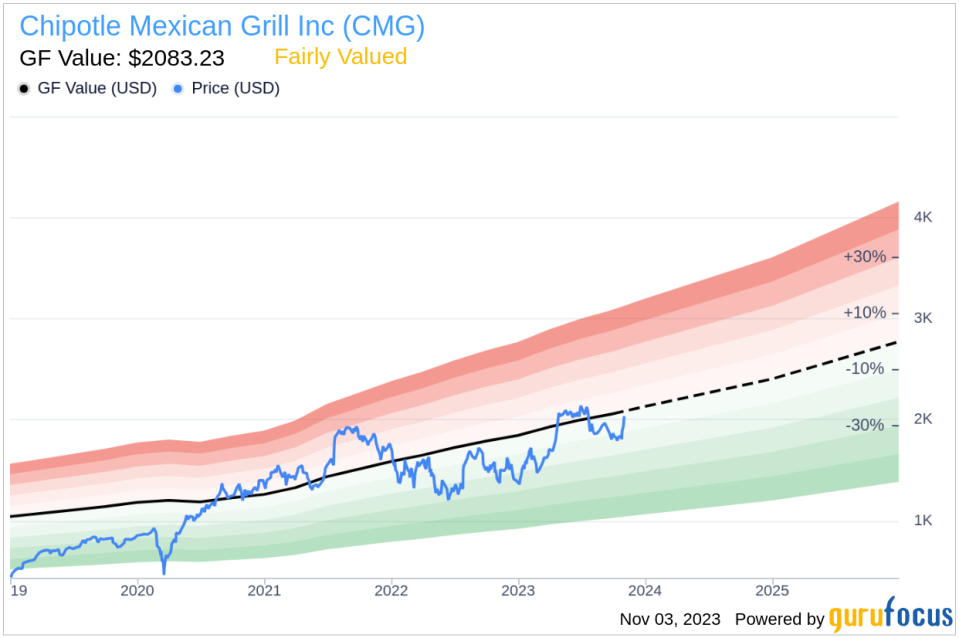

Key Drivers of Chipotle’s Stock Price

Chipotle Mexican Grill’s stock price is influenced by a complex interplay of factors, including its financial performance, industry trends, macroeconomic conditions, and investor sentiment. Understanding these key drivers is crucial for investors seeking to assess the potential value and risk associated with Chipotle’s stock.

Earnings Reports and Financial Performance, Chipotle stock

Chipotle’s earnings reports are a primary driver of its stock price. Investors closely monitor the company’s revenue growth, profitability, and same-store sales, which are key indicators of its operational performance. Strong earnings reports typically lead to positive stock price movements, while weak results can trigger sell-offs. For example, in the first quarter of 2023, Chipotle reported a 17.2% increase in revenue and a 10.3% increase in comparable restaurant sales, exceeding analysts’ expectations. This positive performance resulted in a significant surge in Chipotle’s stock price.

Industry Trends and Competitive Landscape

The fast-casual restaurant industry is highly competitive, with players like McDonald’s, Taco Bell, and Subway vying for market share. Chipotle’s stock price is affected by industry trends, such as consumer preferences for healthier and more sustainable food options, and the rise of digital ordering and delivery services. For instance, Chipotle’s focus on fresh, high-quality ingredients and its strong digital presence have helped it gain market share and attract investors.

Macroeconomic Conditions

Chipotle’s stock price is also influenced by broader macroeconomic conditions, such as inflation, interest rates, and consumer spending. During periods of economic uncertainty, consumers may reduce their discretionary spending, which could impact Chipotle’s sales and stock price. Conversely, a strong economy with low unemployment and rising consumer confidence can benefit Chipotle’s business.

Pricing Strategies

Chipotle’s pricing strategies have a significant impact on its profitability and stock performance. The company has consistently raised prices over the years to offset rising food and labor costs. While this strategy can boost profitability, it can also lead to customer pushback if prices are perceived as too high. Investors closely monitor Chipotle’s pricing decisions and their impact on sales and margins.

Investor Sentiment and Market Expectations

Investor sentiment and market expectations play a crucial role in shaping Chipotle’s stock price. Positive investor sentiment, driven by factors such as strong earnings, new product launches, or positive industry trends, can lead to a rise in the stock price. Conversely, negative sentiment, fueled by concerns about competition, food safety issues, or macroeconomic uncertainty, can depress the stock price. Market expectations for Chipotle’s future performance also influence its stock price. If analysts and investors are optimistic about the company’s growth prospects, the stock price is likely to be higher. Conversely, if expectations are low, the stock price may be depressed.

Role of Analyst Ratings

Analysts’ ratings and price targets for Chipotle’s stock can also influence investor sentiment and the stock price. Positive ratings and high price targets can encourage investors to buy the stock, while negative ratings and low price targets can lead to selling pressure. For example, if a prominent investment bank upgrades its rating on Chipotle’s stock, it can send a positive signal to the market and lead to a price increase.

Social Media and Public Perception

Social media platforms have become increasingly important in shaping public perception of companies, including Chipotle. Positive mentions and reviews on social media can boost investor sentiment and drive up the stock price. Conversely, negative publicity, such as food safety incidents or social media controversies, can damage Chipotle’s reputation and lead to a decline in its stock price.

Future Prospects and Potential Risks: Chipotle Stock

Chipotle’s future prospects are tied to its ability to maintain its strong brand, expand its reach, and navigate the ever-changing landscape of the fast-casual dining industry. While the company has demonstrated impressive growth in recent years, several potential risks could impact its stock price and long-term sustainability. This section will delve into Chipotle’s growth prospects, identify potential risks, and discuss the long-term sustainability of its business model.

Growth Prospects

Chipotle’s growth prospects are promising, driven by its expansion plans and new product offerings. The company is actively opening new restaurants in both existing and new markets, expanding its reach and increasing its customer base. Chipotle’s digital ordering and delivery services are also contributing significantly to its growth, catering to the increasing demand for convenience and online ordering.

Expansion Plans

Chipotle has set ambitious goals for its expansion, aiming to open hundreds of new restaurants in the coming years. The company is focusing on both urban and suburban locations, targeting areas with high population density and strong disposable income. This strategy allows Chipotle to tap into new markets and attract new customers.

- International Expansion: Chipotle has already made inroads into international markets, with restaurants in Canada, the UK, and France. The company plans to further expand its international presence, targeting countries with a strong appetite for fast-casual dining and a growing middle class. This strategy opens up new growth opportunities and diversifies Chipotle’s revenue streams.

- Focus on Drive-Thrus: Chipotle is increasing its investment in drive-thru locations, recognizing the growing popularity of this format. Drive-thrus offer a convenient and efficient way for customers to order and receive their food, particularly during peak hours. This strategy helps Chipotle cater to a broader customer base and increase its sales.

New Product Offerings

Chipotle is constantly innovating and introducing new products to its menu, keeping its offerings fresh and appealing to customers. The company has introduced new menu items like the Lifestyle Bowls, catering to specific dietary needs and preferences. These new offerings expand Chipotle’s customer base and appeal to a wider range of consumers.

- Digital Ordering and Delivery: Chipotle’s digital ordering and delivery services have been a major growth driver. The company’s online ordering platform allows customers to place orders conveniently from their phones or computers, and its partnership with delivery platforms like DoorDash and Uber Eats has made its food accessible to a wider audience.

- Focus on Customization: Chipotle’s “build-your-own-bowl” concept has been a key driver of its success. Customers can customize their meals with a wide variety of ingredients, allowing them to create meals that meet their individual preferences. This strategy has been particularly successful in attracting health-conscious consumers.

Potential Risks

While Chipotle’s growth prospects are strong, several potential risks could impact its stock price and long-term sustainability. These risks include competition, regulatory changes, and economic downturns.

Competition

The fast-casual dining industry is highly competitive, with numerous players vying for customers’ attention. Chipotle faces competition from established players like Panera Bread and Subway, as well as newer entrants like Sweetgreen and Cava. This competition can impact Chipotle’s pricing power, market share, and profitability.

Regulatory Changes

The food industry is subject to various regulations, including food safety standards, labor laws, and environmental regulations. Changes in these regulations could impact Chipotle’s operating costs, profitability, and brand image. For example, stricter food safety regulations could lead to increased costs for compliance, while changes in labor laws could impact the company’s staffing levels and labor costs.

Economic Downturns

Economic downturns can significantly impact consumer spending, leading to reduced demand for discretionary items like restaurant meals. During an economic downturn, customers may opt for cheaper alternatives, reducing Chipotle’s sales and profitability.

Long-Term Sustainability

Chipotle’s long-term sustainability depends on its ability to maintain its strong brand, expand its reach, and adapt to the evolving landscape of the fast-casual dining industry. The company’s focus on fresh ingredients, customization, and digital ordering and delivery positions it well for long-term success. However, the company needs to continue to innovate and adapt to stay ahead of the competition and meet the evolving needs of its customers.

Key Factors for Sustainability

- Brand Management: Maintaining its strong brand image is crucial for Chipotle’s long-term success. The company needs to continue to emphasize its commitment to fresh ingredients, ethical sourcing, and sustainability. This will help Chipotle differentiate itself from its competitors and attract loyal customers.

- Innovation and Adaptability: The fast-casual dining industry is constantly evolving, and Chipotle needs to remain innovative and adaptable to stay ahead of the competition. This includes introducing new menu items, exploring new delivery options, and embracing new technologies.

- Cost Management: Chipotle needs to effectively manage its costs to maintain its profitability. This includes controlling labor costs, optimizing its supply chain, and negotiating favorable lease terms.

Chipotle stock has seen significant fluctuations in recent years, reflecting investor sentiment about its growth trajectory and operational efficiency. It’s interesting to note that the current CEO of Chipotle, Brian Niccol, previously held the position of CEO at Starbucks where he spearheaded a successful digital transformation strategy.

Niccol’s experience in leading a large-scale consumer brand with a focus on digital engagement could be valuable in navigating the evolving landscape of the fast-casual restaurant industry and driving continued growth for Chipotle.

Chipotle Mexican Grill, known for its fast-casual dining experience and commitment to fresh ingredients, has seen its stock fluctuate in recent years. The performance of the stock is closely tied to the leadership and strategic decisions of CEO Brian Niccol, whose own net worth is a subject of public interest.

To understand how Brian Niccol’s wealth may be linked to Chipotle’s stock performance, one can explore resources such as brian niccol net worth. However, it’s important to note that a CEO’s net worth is not a direct indicator of a company’s stock performance, as various factors contribute to stock fluctuations.